Personalized Wealth Management

Rooted in Clarity and Care

Guiding accomplished individuals and families for over two decades with personalized strategies, thoughtful partnership, and enduring support at every stage of their financial journey.

About Sinhasi

Personalized Virtual Family Office | SEBI Registered Investment Adviser

26+

Years of experience

150+

Family Served

3 Generations

Relationships Spanning

HOW WE HELP YOU WIN

The Sinhasi Way

Protect

Your Wealth

360° HOLISTIC WEALTH PLAN

WILL & ESTATE PLANNING

INSURANCE PLANNING

Enrich

Your Investment

INVESTMENT PLANNING

REAL ESTATE PLANNING

TAX PLANNING

Nurture

Your Financial Wisdom

SMART ABOUT MONEY

STARTING 'EM YOUNG

WOMEN & MONEY

Our Service Suites

Delivered with Professionalism and Client-First Approach

Holistic Wealth Management

A focused, flexible & personalized service designed for individuals & families seeking professional guidance & ongoing support for their financial goals.

Virtual Family Office Advisory

A dedicated and holistic approach for families seeking to coordinate and enhance every aspect of their financial affairs.

What sets us Apart

Balancing Vision, Strategy, and Agility — The Sinhasi Way.

The Zen of Investing

‘The Zen of Investing’ is about always keeping a steady mind in “Dynamic Balance” at all times. Combining alertness & calmness during turbulence, coupled with execution excellence facilitates that your money grows in the optimum way. KNOW MORE

Personalized 360° Wealth Plans

Personalised Wealth Plans are specially prepared for you in line with your Family Goals. We take this very seriously and hence spend time to understand your attitude towards risk and reward, your time horizons, and other key factors that matter to you.

Agile Execution

We curate the right mix of investment solutions, best suitable for you, that enables sustainable Alpha returns, even during turbulent times. We execute on time with service excellence so that never is an opportunity lost.

Start Your Legacy Today!

Connect With Us

STAY UPDATED!

Track your Portfolio

WITH THE SINHASI CLIENT PORTAL

THE WORDS THAT MATTER

Testimonials

Mr. Ajoy Chawla

Managing Director, Titan Company Ltd.

BENGALURU • CLIENT SINCE 2007

“Disciplined, holistic yet simplified financial planning that Sinhasi has helped me with has enabled me to eliminate the pressure or guilt …”

READ TESTIMONIAL

Mr. Gaurav Gandhi

Vice President, Amazon Prime Video, Asia-Pacific & Middle East-North Africa

MUMBAI • CLIENT SINCE 2006

“Mimi & her team evoke that kind of TRUST and COMFORT for every advise they give their clients…”

READ TESTIMONIAL

Mr. Sandeep Singh

MD, Tata Hitachi Constructions Machinery Ltd

Former MD, Toyota Motors (APAC)

BENGALURU • CLIENT SINCE 2012

“I have benefitted financially with their investment plan made for me and reiterate my full confidence in them.”

READ TESTIMONIAL

We firmly believe that managing investments and portfolios is a very serious business. We stand firm and accountable for each one of our clients’ financial goals & their future as well as for their families. That is why we are preferred investment partners to our clients over the past several years.

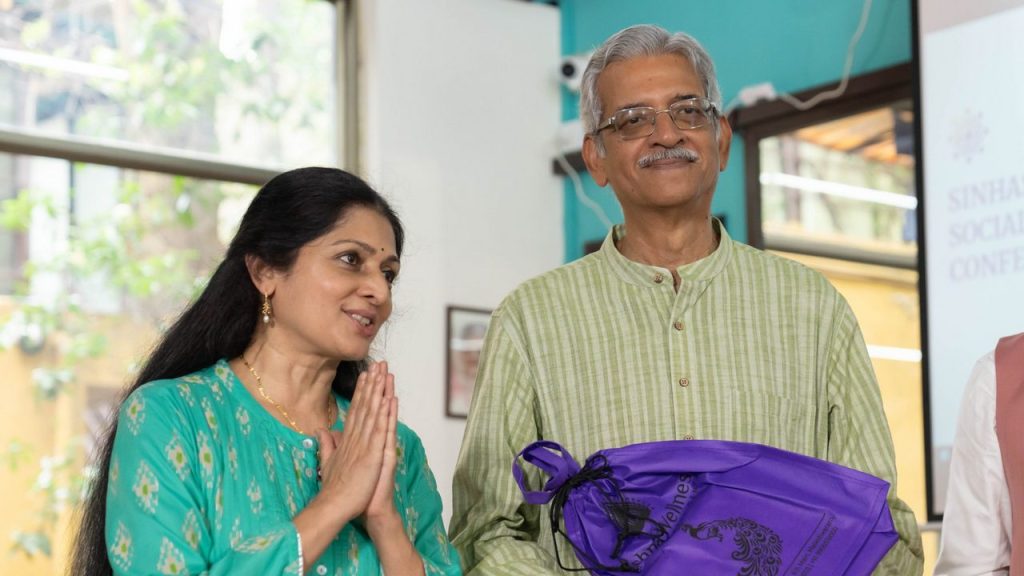

MIMI PARTHA SARATHY

Managing Director,

Sinhasi Consultants Pvt. Ltd

The Zen of Investing

Our philosophy focussed on Dynamic Balance is the key to sustainable financial success.

Constant focussed alertness combined with calmness, especially in the midst of market volatility and turbulence, enables sustainable alpha returns for your investments.

Events and Engagements

Cutting edge knowledge with deep analysis enabling the right conversations ‘to get better at getting better’ at your financial success with prudent management.

Personal Finance for Investors

Retiring Soon? What’s your plan?

As a retiree, it’s important to consider your investment options carefully in order to ensure that your savings will last throughout your retirement. One option to consider is investing in debt, such as bonds or other fixed-income securities. While investing in debt can offer some benefits, it is not necessarily the best choice for everyone, and it’s important to weigh the potential pros and cons before making a decision.

Achieving Zen: 7 Steps to Financial Success with Balance & Joy

This is a captivating journey, a journey where we explore the art of balancing wealth and enjoyment. It’s a topic that holds significance for many of us as we navigate the complexities of financial success and the desire for a fulfilling life. We’ll delve into practical strategies that can help us

Why Do People Lose Money in Equities? –11 Mistakes to Avoid

Equity as an asset class is by far the top-performing asset classes for long-term investments. Over time, equities generate higher returns than other asset classes such as bonds, cash, and real estate. While equities can be volatile in the short term, subject to market fluctuations, they provide investors with the most attractive returns over the long term. But that doesn’t mean investors don’t lose money in it. Despite potentially higher returns, equities are subject to market volatility brought on by economic conditions, industry trends, and geopolitical events. In fact, stock market crashes and downturns are not uncommon, and investors who are not prepared to weather these events will suffer significant losses. Investors tend to lose money in the stock market by making the mistakes listed below.

READ OUR BLOGS

The Silent Risk Nobody Notices When Returns Are High

Health of Your Wealth – Jan 2026

When the Past Feels Permanent: Why Return Expectations Need a Reality Check

Featured In